Small Nikah to a £100k Wedding: 3 Brides Share Their Financial Tips With Us

by Amaliah Team in Culture & Lifestyle on 31st January, 2022

What is it that makes a wedding memorable? Is it the food, the dessert tables? The photo booths or just the fact loved ones are gathered to witness the special union of two people before Allah? We turned to the Amaliah community to ask them how they prepped and planned for their big day. To our absolute delight, over 100 Muslim women from the UK and abroad stepped forward to spill the tea on their exciting courtships and beautiful weddings.

From seven-event extravaganzas to DIY successes, potluck weddings and cakes that toppled over, we read and loved every single story, we even shed a tear or two reading through the beautifully unfolding events and laughed out loud over the funny mishaps, in-law dynamics and anecdotes. We’ve spotlighted three stories on varying ends of the spectrum and talked about everything from budgets to all the things that went right and wrong.

Whether you’ve always dreamed of a big fat wedding spanning over a number of days or you consider yourself part of the Small Nikah gang that’s risen in popularity during lockdown, learn how three different women planned for their weddings!

There are many things to factor in when planning a wedding, and for many couples, their wedding budget is at the top of that list as it can determine so much about the kind of wedding you end up having.

It can be really helpful to hear from other couples about their own wedding planning experiences, how they saved for it, how much they spent on it and what they wish they had known before embarking on this journey. That’s why Amaliah has partnered with Lloyds Bank to showcase the stories, experiences and advice of others that have already been through the process to help couples plan and budget for their big day!

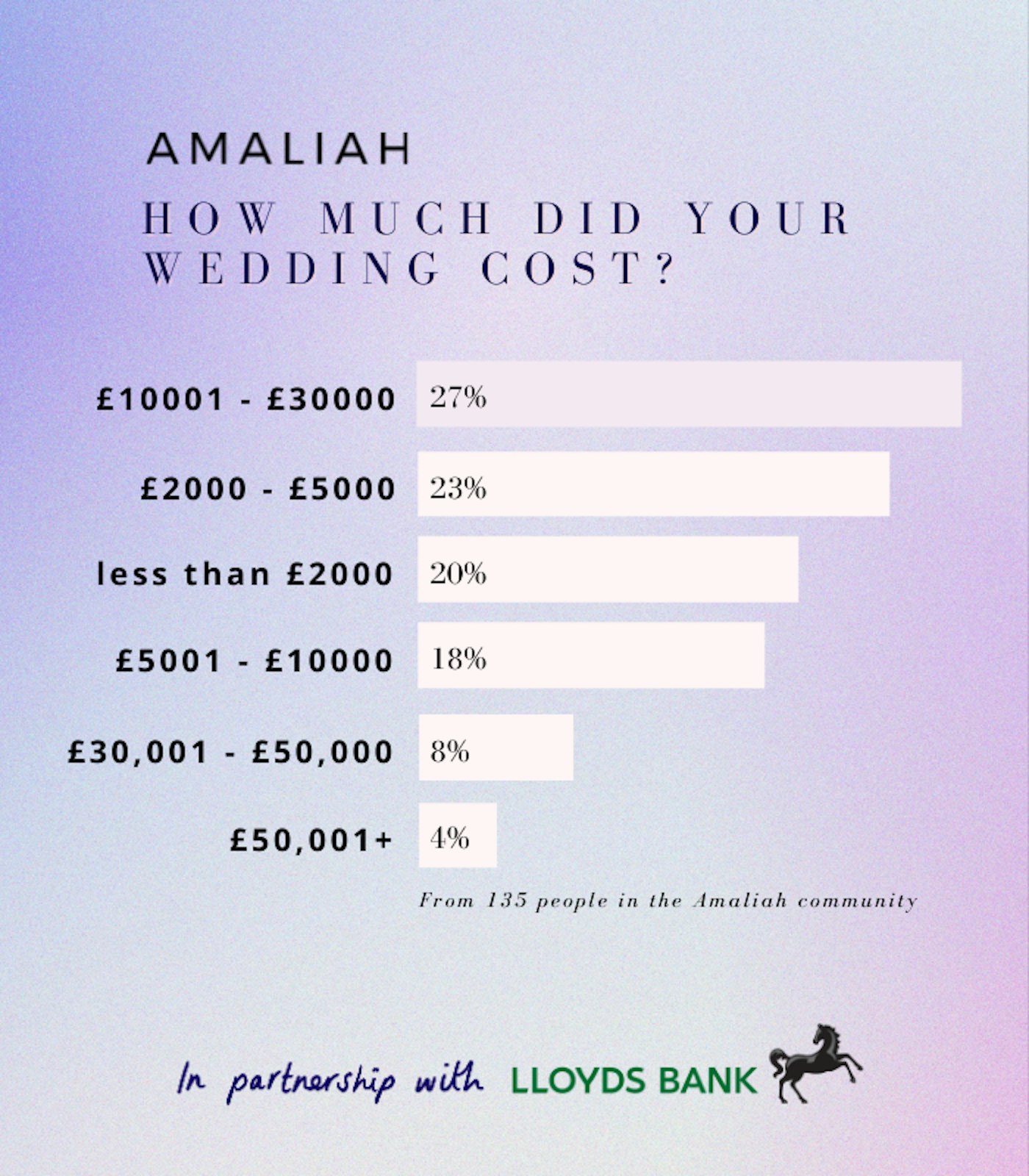

Perhaps the first thing that comes to mind when planning for your special day is the cost. As part of our open call, we asked the Amaliah community how much they spent on their weddings and the results were a mixed bag – though the majority said that they had spent over £10,000 on their wedding, weddings on a budget between £2000-£5,000 were also very common. Many of those who had spent less than £2000 on their wedding were those that had intimate lockdown gatherings with the help of some DIY, thrifting and bargain hunting.

Planning a wedding can often be a stressful experience, but it needn’t be! As the following experiences and stories from the Amaliah community show, whatever your budget, you can make it work and plan a special day to remember!

Amaliah Community Top Wedding Budgeting Tips

- Weekday weddings can significantly reduce the cost of your wedding venue so if you’re looking to reduce costs, consider booking a venue during off-peak hours. – Aisha Stockton

- Don’t be afraid to negotiate on your venue. Often the price is not completely fixed and there is room to knock some £££ off which you can put towards other costs in your wedding plan. – Anonymous

- If you’re looking for a budget-friendly dress option, then check out wedding dress sample sales. This is when a bridal boutique sells their designer sample gowns at a heavily discounted price and they can have a variety of options for you to choose from. – Lubaba Khalid

- Try to book an all-inclusive venue with decoration and catering packages included. It can save you time and stress, and sometimes, it works out to be cheaper than sorting everything out yourself! – Lubaba Khalid

- In addition to the Amaliah community tips Lloyds Bank has some more useful tips that will help you budget for your big day, including a free budget calculator that can help you decide on a realistic figure to put aside to save for your wedding.

The Seven-Part Wedding Extravaganza

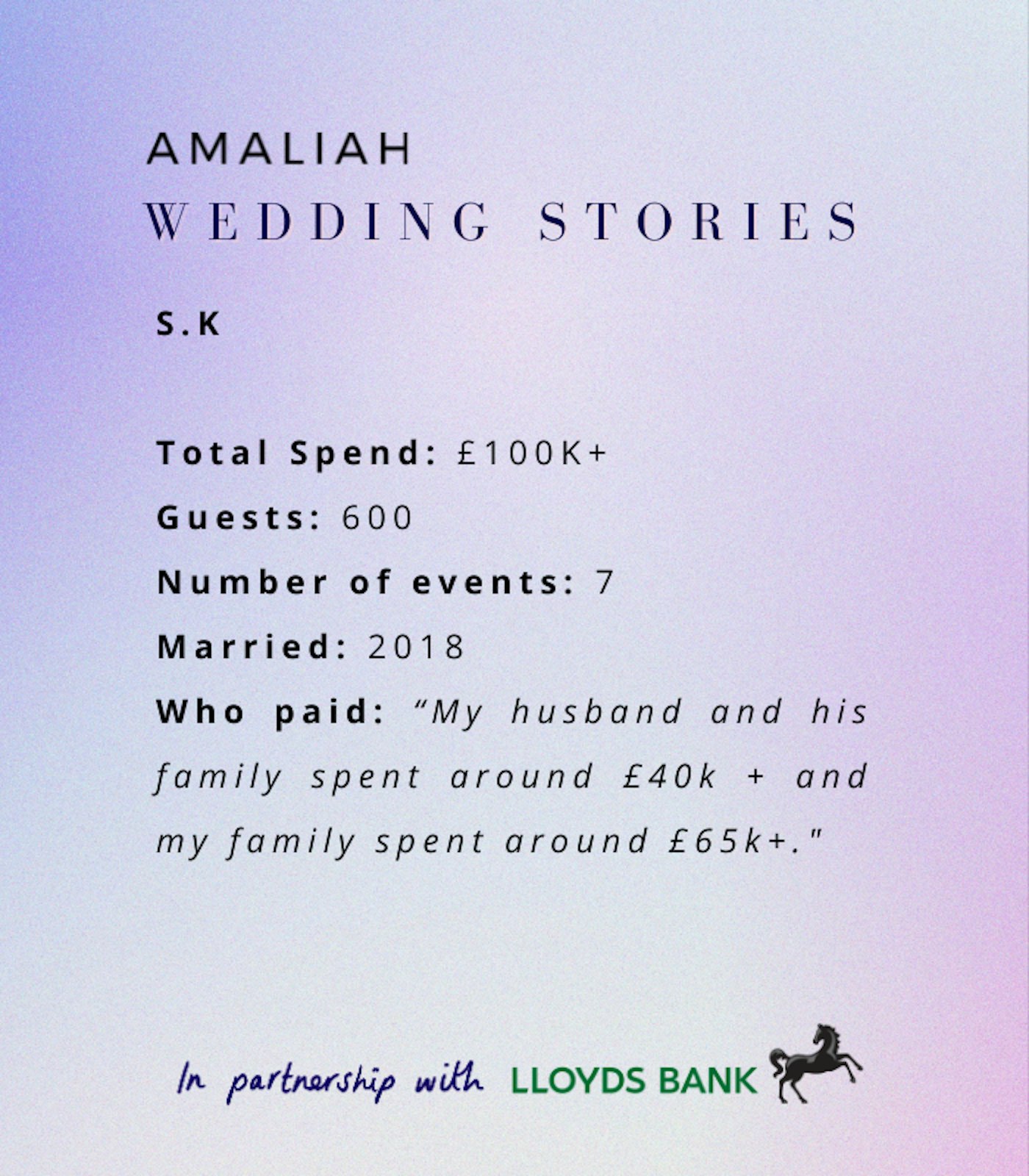

S.K

Married: 2018

£££: £100k +

Who paid: “My husband and his family spent around £40k + and my family spent around £65k+. Looking back it’s a ridiculous amount of money to spend on a few days.”

S. Hosted a whopping 600 guests spread out over seven different events at her £100k wedding.

When S. met her husband she was working as an administrator for the NHS and did some freelance writing on the side. One of the pieces she was working on was from the point of view of a single Muslim in the dating world. A bout of procrastination led her to download some dating apps where she met her husband, and in S.’s own words, “the rest is history”.

The couple got married in 2018 with the towering cost split unevenly between S.’s father, her husband and his family. For this couple, the cultural pressure to have an extravagant wedding was always sky-high.

For one, S. is the eldest daughter in her family and her husband is the eldest son of his. Both sets of parents had always felt an obligation to throw a massive wedding that the community would approve of and remember for years to come.

S is now clear about one thing that every bride and family needs to consider- never factor in the aunties when budgeting for your wedding.

In retrospect, S. feels her wedding was a bit excessive especially since the very guests the whole wedding had been planned for were bent on nitpicking on the tiniest details: “I had an auntie say how my wedding day was perfect but it was ‘too hot’- it was one of the hottest summers in the UK, I am not God, I can’t control the weather!”

But on the bright side, S. and her husband both enjoyed their more intimate Nikah and registry events. S. admits she would have loved a lockdown wedding because it would have been an excuse to only invite her nearest and dearest, as opposed to everyone, “from my dad’s childhood friend from America (who I have never met) to my sister in law’s hairdresser!”. She says looking back they could have just combined the money and had one big event but “there was too much pride that got in the way” and the pressure also came from her parents feeling obliged to spend money and invite as many people to show off that their daughter is getting married.

“It is definitely tricker when others are helping you financially but remember that your Nikah and registry is what is important, everything is a plus and ISN’T required in the eyes of God.”

When we asked S. what money can’t buy at a wedding, she answered “my love for my husband and the care and protection he has for me is priceless; that never went through all the dramas and struggles during pre and post marriage.”

“Never forget that it’s YOU and YOUR partner getting married and YOU BOTH should decide who’s coming or not and how you want your big day to be.”

If we had to pull apart the many themes in S.’s story and pick just one that stands out to us, it’s the importance of taking setbacks with grace and cherishing memories of your loved ones. Joy is only multiplied by sharing it with those who are truly happy for you.

Top tips from the Amaliah community: Budget around your dreams, values and pocket

“Never forget that it’s YOU and YOUR partner getting married and YOU BOTH should decide who’s coming or not.” – S

“Be adamant that it is your day and what you want, you get. You have every right to call the shots and make the decisions – you are the one that is getting married.” – Zara Shabir

“Think about what you want to remember AFTER the wedding. That lasts one day but the memories last forever. Have a budget that includes a ‘what if’ amount allocated. Ask your partner what THEY want to remember from the wedding.” – Haafizah Hoosen

“Paying for everything ourselves meant no debt, no borrowing, no owing anyone anything and no nonsense about dictating the wedding. We had autonomy, ownership and peace with the logistics.” – Taz

“Take time together to work out how much you can afford and what you’re actually willing to spend. If you’re planning to save up to boost your wedding fund, you’ll need to work out your monthly income and outgoings so you can decide on a realistic figure to put aside on a regular basis. Our online budget calculator can help you to do this.” – Lloyds Bank

The Big Barakah Wedding

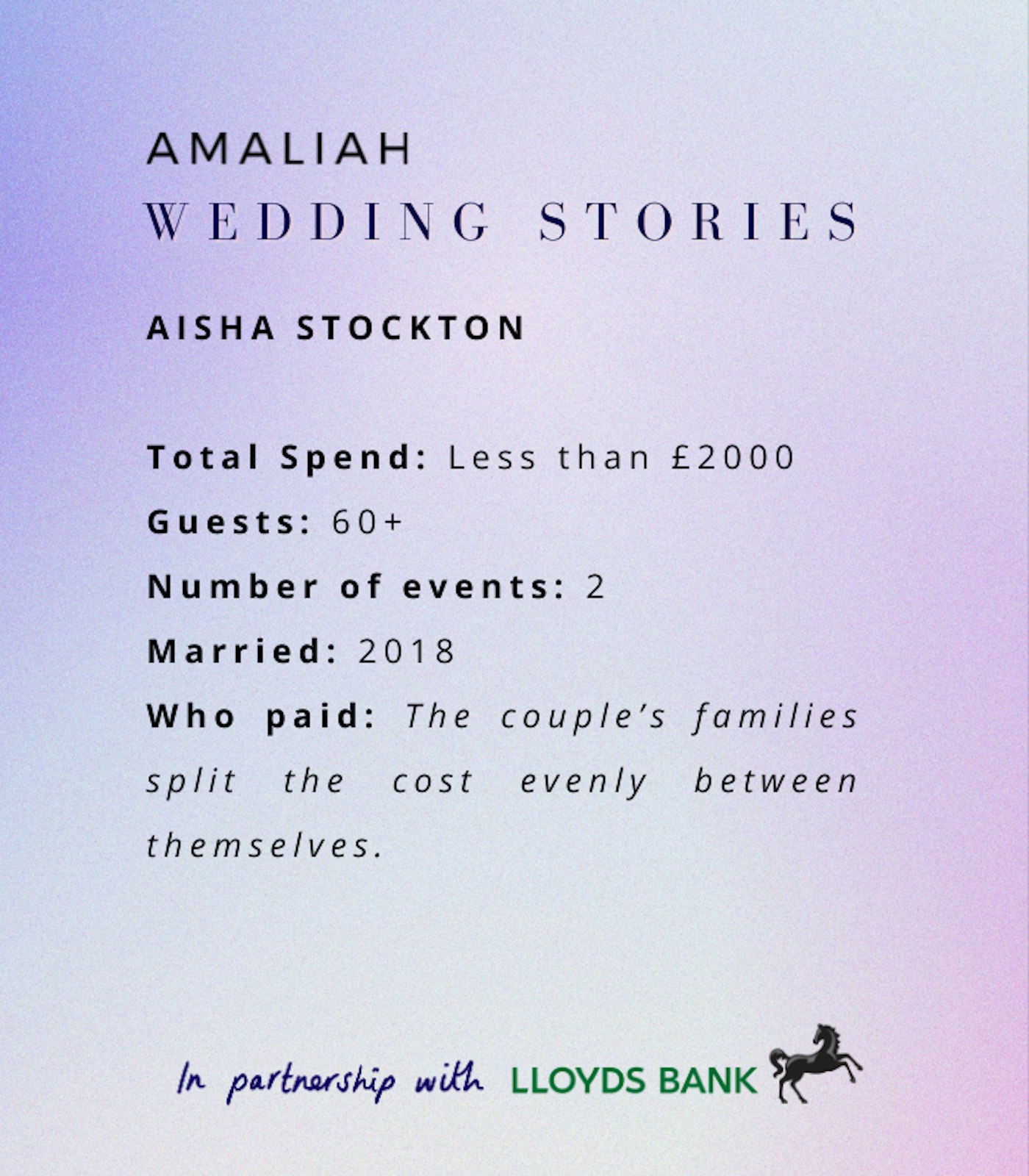

AISHA STOCKTON

Married: 2018

£££: Less than £2000

Wedding Cost Breakdown:

Nikah venue = £0

Nikah food = £0

Ceremony = Town halls often have off peak cheaper time slots, costed £50-100

Walima 1 (meal) = £900

Walima 2 (renting tables and chairs) = £100

Aisha dress = £60

Partner suit = £70

Decor = £100

Aisha’s story has a double dose of love and warmth. As a university student new to London, Aisha was struggling to settle into a new life and felt very overwhelmed.

She met her husband who was in a similar phase of life, “we were each other’s support during that”, and a wedding was planned during their second year of university. On the way to her classes, Aisha also came across a community garden which ended up being a forever safe space that she visits even now with her child.

The women that ran the space took Aisha under her wing, becoming “like maternal figures.” They provided her with a space to drop in for tea and conversation, a little home when she needed it most. She began volunteering there and when it was time for her wedding, the venue was gifted to her for her Nikah event.

The couple had a clear idea of how they wanted their wedding to unfold. They wanted to be on the same page, they wanted to have it small and they wanted their families to be as involved as possible, while also having their personal choices and wishes respected.

“We tried to do everything ourselves and at a very cheap price – my dress cost £80 online, we picked flowers from our garden, we made decorations ourselves and lots of people from our family helped out with any extra bits.”

For Aisha and her husband, setting those boundaries worked out really well. Their friends and family were more than happy to help and Aisha advises couples not to shy away from asking loved ones for what they need, “they’ll just be honoured that you’re including them.”

Splash or Save? What to spend or save your money on according to the Amaliah community

- SPLASH: A good photographer/videographer. It’s nice to have good-quality photos and videos you can look back on to remind you of your special day and to pass down. – Hiba Khan

- SAVE: The cost of designing, printing and sending physical invitations for your wedding can quickly add up. A great alternative is a digital invitation or video invite that you can share with your loved ones at the click of a button!

- SPLASH: If you’re short on time (or patience!) a wedding planner can save you so much time and effort so that you can focus on enjoying your wedding day without the hassle of searching for venues and special deals. – Samirah Siddiqui

- SAVE: Offering your guests favours is a long-standing tradition, but often, they are left behind at the end of the wedding and it can contribute to a lot of unnecessary hassle and waste that you then have to deal with. You can forego them all together but Lloyds Bank recommends that if you’re keen on giving your guests something to remember your day by, there are some great DIY options you can explore and that you can enlist the help of family and friends to make them too!

Aisha scoured the internet for a dress within her budget and DIY-ed all her wedding decor with her enthusiastic entourage. The couple then had two events – one at a restaurant and the second at their student house garden where Aisha’s mother-in-law cooked up a storm and fed over 60 guests.

“Keep it cheap and cheerful for your own sake, if you want to splash some cash maybe use the money for a holiday after or a house!”

“All I know is the food was amazing. I have no recollection of what any of the food tasted like. I was so nervous, I’m pretty sure I didn’t eat anything. And people asked for the recipes after, ‘we’re desperate to know what she made’.”

The couples’ families split the cost evenly between themselves and, all in all, ended up with a bill of less than £2000.

“A lot of it was gifted to us. We were helped by people around us. So it was very much a community wedding; it felt like a lot of people were coming together. Each person was giving something little like they wanted to be part of this new life that we were choosing, which I thought was really beautiful and really lovely.”

Though she loved every aspect of her wedding she jokingly tells us “I maybe would’ve invested in a photographer because the pictures we came out with were shocking, my mum brought her iPad and has about 700 blurred photos!”

Aisha tells couples going into wedding planning to “evaluate what you want your wedding to symbolise.”

“Having that sense of you as an individual being brought into a union, I think subconsciously was really important to me. And just meant that I could bring those parts of my life into this new part.”

And while all weddings symbolise something unique to the couple central to it, Aisha’s wedding teaches us the importance of community and how coming together to celebrate love with love results in barakah galore.

Tops Tips from the Amaliah community: Look for ways to minimize your costs and waste

Shop around “Write everything down! Any money spent on any item. Look at all options and different shops, e.g. if you are interested in a jewellery set, look in different shops, don’t just buy it straight away. You could save money this way or find something better.” – Anonymous

Cater for yourself “The best part the food was cooked by my family members, like a potluck everyone cooked something I liked and lots of it.” – Aisha Khan

Get creative “You don’t have to buy everything new, be creative and you can save on a lot of stuff! Call on goodwill or friends who may be skilled in areas to save you costs. Have a good idea about your guest numbers as that will give better negotiating power when securing venue and service cost per person.” – Gulnahar Savory

Prioritise “Don’t stress yourself out trying to do things how others expect it to be – give yourself permission to step outside of the box and prioritise what’s important – not everything has to be perfect, but pick the things you really want to be right.” – Sabreen Ahsan

“It’s worth spending some time as a couple working out your top priorities for your big day so you can allocate your budget to the things that matter most. There are a lot of potential expenses to consider, from the invites right through to the honeymoon…Time spent browsing these can help to ensure you don’t overlook anything, and give you have a good idea of what things are likely to cost.” – Lloyds Bank

The Destination Wedding

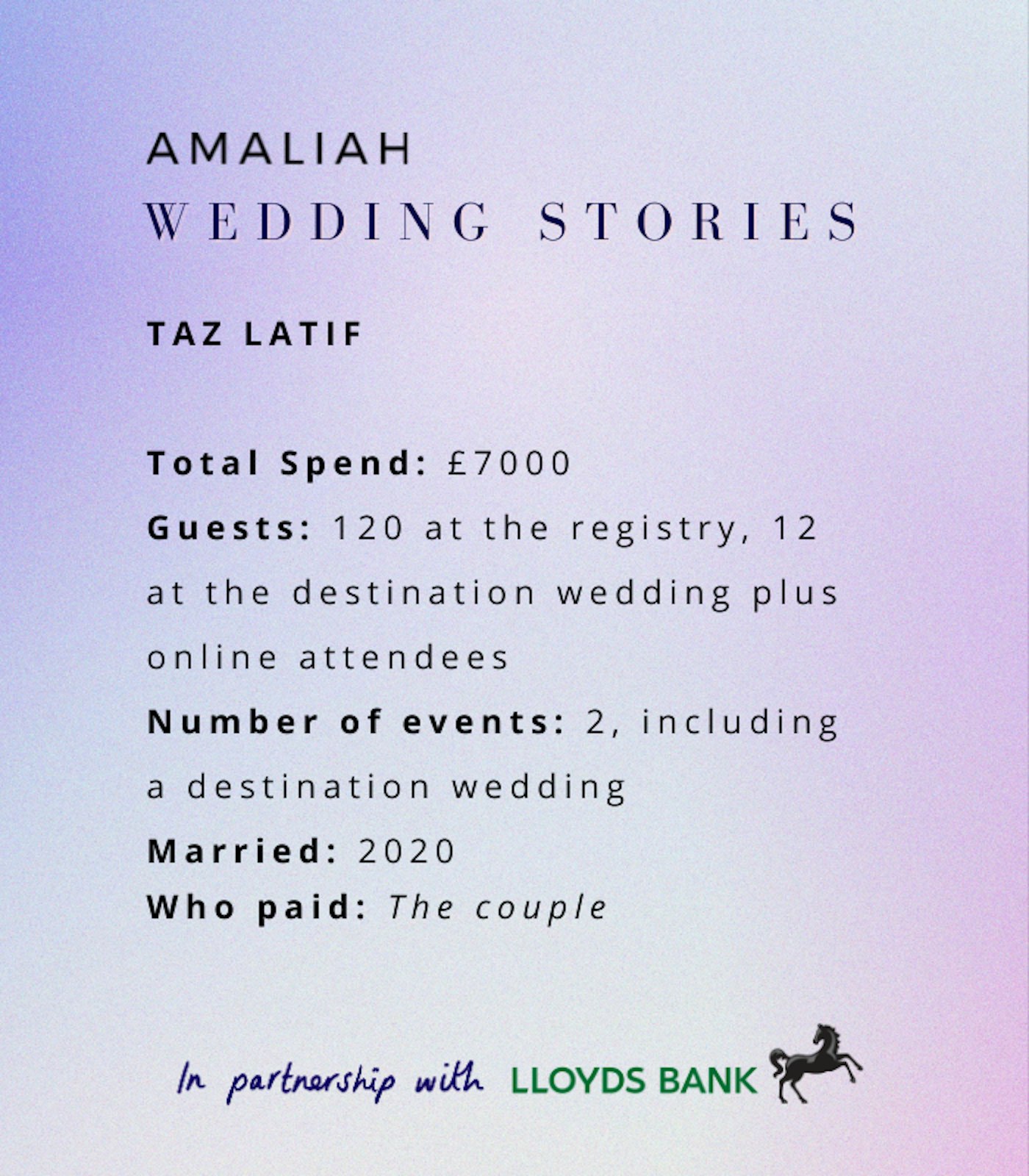

TAZ

Married: First in August 2013, then divorced, then married in August 2020

£££:

First wedding = £40k

Second wedding = £7K including destination wedding in Turkey and a registry a year later in the UK

Who paid: Bride and partner

Wedding Cost Breakdown:

Turkey:

Outfit – £450

Makeup – my sis & bestie

Wedding package – £4000

Rings – £1000 each

Registry:

Outfit- reused above outfit since hardly anyone had seen it

Makeup – £550

Event package with a restaurant – £4700

Nothing warms our hearts more than a story of new beginnings and Taz’s story speaks to the sheer beauty in taking control of your own narrative.

When Taz first got married, she was excluded from the financial decisions despite contributing financially to the costs. She says she would never have let her father and ex-husband take the decisions that led to a £40k, six-part, and a 600+ guest wedding! Taz learnt an important lesson from her first marriage and now ensures that both her and her husband have open conversations and joint decision making when it comes to finances.

“My first marriage was all about big gestures. Unfortunately, it was for the wrong reasons, it was just for show. The whole thing fell apart and if I think back now there was literally no barakah.”

But in 2020, Taz and her husband took finances into their own hands, learning from their past experiences, and pulled off the wedding of their dreams.

The couple planned a destination wedding to Turkey with a 50-person guest list and ended up spending £4000, including a personalised wedding planner (the best decision according to Taz), a seven-course meal, fresh flowers, cake and decor. With full control over the planning and budgeting, Taz and her husband arranged a wedding on the beach with the Imam and their friends and family on Zoom.

Taz and her husband were transparent about finances with each other from the start. According to Taz, if couples were responsible for paying for their own weddings, they would start having difficult money conversations very early on and “any potential red flags would come up then.”

Lloyds Bank’s top tips to help you start conversations with your partner about money

Having regular, honest conversations about your finances is a good way to gain an understanding of your different views towards money and savings. You might have different attitudes to taking on debt, for instance, or to budgeting and spending. Being open about these areas can help to reduce the risk of conflict and help you both make better decisions together.

- Start talking about ‘our money’. This doesn’t mean that sharing all your money will be the right thing for you, but it will help you to feel like a team and reflects the commitment you’ve made to each other.

- Talk about your future goals. This exciting time means you’ll probably be talking about plans for the future. When you do this, make sure to factor in how you’ll save for things- it will make it more realistic that they’ll actually happen.

- Discuss roles and responsibilities when it comes to money. Talk about your strengths and skills. Who will be responsible for the budget and arrange direct debits so that bills are paid?

- Have the joint account conversation. Joint accounts aren’t for everyone, but it’s a good idea to have a chat about whether this is something you want to consider if you haven’t already.

- Schedule in regular money catch-ups. Dedicated time to go over your finances will help you keep on top of things and provide the opportunity to raise any issues there might be.

Click here to read the full list.

There were setbacks in the dream wedding, of course. Taz’s was the first destination wedding in the family and she says she upset quite a few people with her decision, but as two divorcees, Taz and her husband were both quite clear on the things they wanted to do right this time around.

“It had never been done before in our family. I did it. I upset people along the way. But ultimately, they’ve forgotten about that. And they’ve realised that it was a good idea.”

With the onset of the pandemic, the wedding was also pushed back for months and the guest list ended up dropping from 50 to 10 at the last minute.

“I just had to keep my faith. To this day I don’t think I’ll ever understand why Allah delayed it. That being said, we don’t necessarily need to understand Allah’s wisdom to believe in it. And so when things like that happen, I’m just like, this is Allah’s plan. He is the best of planners. I trust Him. I don’t really know why He’s doing this, but I do trust Him.”

But at the end of the day, Taz was more than happy with her wedding and wouldn’t change a thing, “I still can’t believe we did it. Alhamdulillah for every moment. We got back to our complimentary honeymoon suite and we both burst into tears.”

We asked Taz for her favourite memory from her wedding:

“Becoming his wife. Seeing my parents and my siblings and a few of my close friends sit down to eat a meal. And us just stopping before we eat to pray our first prayer together, our first two rakahs together in thanks to Allah, on the beach, coastal breeze, candlelit dinner and in that moment my heart was so content.”

Taz’s own words are definitely the best conclusion to her story.

May Allah grant us all the wisdom to trust Him when things don’t seem to be going quite right and may He reward us all with hearts bursting with contentment. Ameen.

Top tips from the Amaliah community: Center Allah and His Messenger in all of your experiences

“Don’t negotiate on the deen. Stay as close to the sunnah of Prophet Muhammad ﷺ as much as you can. Ask Allah for strength and guidance because it is so much harder to stand up to your loved ones than it is to stand up to an enemy.” –Anonymous

“Stand by your intuition and instincts, real respect and honour from the family you’re marrying into won’t (shouldn’t!) come from financial spending. Do istikharah for difficult decisions and negotiations and keep your focus on the marriage ahead beyond the big day. Be diplomatic and wise in balancing everyone’s input and perspectives but don’t compromise on your key values.” – Hiba Khan

Set your priorities

“Spend that money on something else. Get a five grand honeymoon if you can afford it. Save up some money and put it into a home so you can start a family and have ample space to raise kids. Put it into a masjid, in both of your names so that you can get Sadaqah Jariyah (continuous charity) every time someone prays. There’s so many beautiful ways you can spend that money. Getting into debt for one day is not the one.” – Taz

“At the end of the day the main priority is the people you have there with you, the photos and videos you’ll have to look back on and the precious experience of bringing your family and your husband’s together. You won’t remember or care about the little details on the actual day, you’ll care about the real priorities way more, you’ll see!” – Malak Obaidi

The top 3 financial tips to consider before your wedding day.

- What is the most important aspect for you on your wedding day? e.g great food, venue, decor – this will help you determine what you should spend the most on.

- Have open discussions with your partner on budgeting for your wedding and make sure you’re both clear on who’s paying for what to make sure you’re both on the same page.

- Your wedding day is just the start of your journey together, which includes your financial journey as a couple. In your conversations about finances, don’t forget to factor in future events and financial considerations like your honeymoon or buying a house together.

We went into these interviews very curious to hear whether a bigger wedding meant a better one and how much money was too much to spend on a wedding.

The best weddings overall are those that are big on community and celebration, where couples gush about things that money can’t buy – like joy, togetherness and laughter. The best weddings are those where couples and their guests emerge with bellies full of good food and hearts bursting with love for each other.

Another important factor we noticed is being open and comfortable with your partner about discussing your finances. The start of a marriage is a great opportunity to begin discussing your financial future together, and if you’re not sure where to start, then Lloyds Bank has some pointers you can think about and discuss with your partner, from reviewing your shared finances to writing a will.

And as with everything in this life, if done with the intention to please Allah, a wedding can lead to goodness in the aakhirah.

May Allah bless every couple with barakah, love and togetherness.

Amaliah Team

This article was written by a member of the Amaliah team or a collective team effort. You can follow us on @amaliah_tweets for the latest or head over to our Instagram @amaliah_com. If you're reading this and are thinking about contributing an article then send us an email with a brief or a full article to contribute@amaliah.com