With Ramadan right around the corner, many of us will be making preparations and plans for fasting. But one crucial obligation we should not forget about is calculating the Zakat we owe for the year. To refresh your knowledge of one of the most important aspects of Islam, we have compiled a short guide that will answer your most pressing questions about Zakat.

This post is sponsored* by The National Zakat Foundation (NZF). NZF receives your Zakat and distributes it to thousands of Muslims in need across the UK. They also offer free one-to-one consultation sessions with one of their Zakat experts.

The opinions presented in this article are that of NZF and have been approved by a religious authority.

1. What is Zakat?

The word Zakat itself means “that which purifies”, and it is mentioned 32 times in the Qur’an. It’s a compulsory payment for Muslims to redistribute and purify our wealth. It is an obligation that we owe to Allah as the third pillar of Islam as well as to those that can receive Zakat, including the poor and needy.

Zakat is often incorrectly translated to ‘charity’, but Zakat and charity, or Sadaqa, are two separate concepts; on the one hand, Zakat is a religious obligation, think of it like Salah or Fasting, on the other hand Sadaqa is a voluntary good deed.

Zakat is 2.5% of your total wealth but not everyone has to pay it.

2. Should you be paying Zakat?

It can often be confusing to figure out whether you should be paying Zakat or not. Zakat should only be paid by people who meet four criteria:

- You are a Muslim

- You have hit puberty

- You are of sound mind

- You have hit a certain wealth threshold. In Islam, we refer to this threshold as Nisab*.

*Nisab is the minimum amount of wealth you must have in order to be liable to pay Zakat. If you don’t hit this wealth threshold, then you are actually eligible to receive Zakat – that’s why it’s seen as a redistribution of wealth.

Read more: A Step-by-Step Guide To Paying Zakat Al Fitr

3. What is Zakat due on?

Zakat is only calculated on wealth that you have full ownership of. This includes things like:

- Cash

- Savings

- Some types of pensions

- Foreign currency

- Stocks, shares, and cryptocurrencies

- The total value of any income generated from renting out a property you own, even if it’s on a mortgage

- The value of any wealth you have given out that you expect to be returned to you like money you’ve let someone borrow

- The value of any gold and silver you own

Paying Zakat on Gold

There is a difference of opinion on if the gold you wear should be included in your calculation for zakat. According to the Hanafi school of thought, Zakat is due on this gold and silver regardless of if you wear it. According to the other schools of Islamic law, Zakat is not due on gold that you wear. However, gold that you have as an investment should be included in the calculation.

Use the National Zakat Fund’s detailed Zakat Guides for a full list of what assets and funds Zakat is due on and what is not considered in calculations. Please note in the context of discussing Zakat, there is a difference of opinion on how some aspects of Zakat are calculated. The opinions presented in this article are that of NZF and have been approved by a religious authority.

4. How can you calculate your Zakat?

There are a few different ways you can calculate your Zakat. One of the easiest ways is the Snapshot method. Think of it like taking a snapshot of your wealth. The snapshot includes, what you own and what you may owe and then seeing if the difference is above the nisab amount. If the difference is above the nisab, you are eligible to pay Zakat, if it isn’t you are eligible to receive it.

Nisab

There are two Nisab values, set by Prophet Muhammad ﷺ himself:

- Gold: the monetary value of 87.48 grams of gold

- Silver: the monetary value of 612.36 grams of silver

To calculate your Zakat payment for the year, check the current gold and silver market rate in your currency. The National Zakat Foundation updates its page daily with the current Nisab rate of both gold and silver. People often use the value of silver to measure the Nisab because the lower threshold means that more people are eligible to pay Zakat, and so more people in need can receive it.

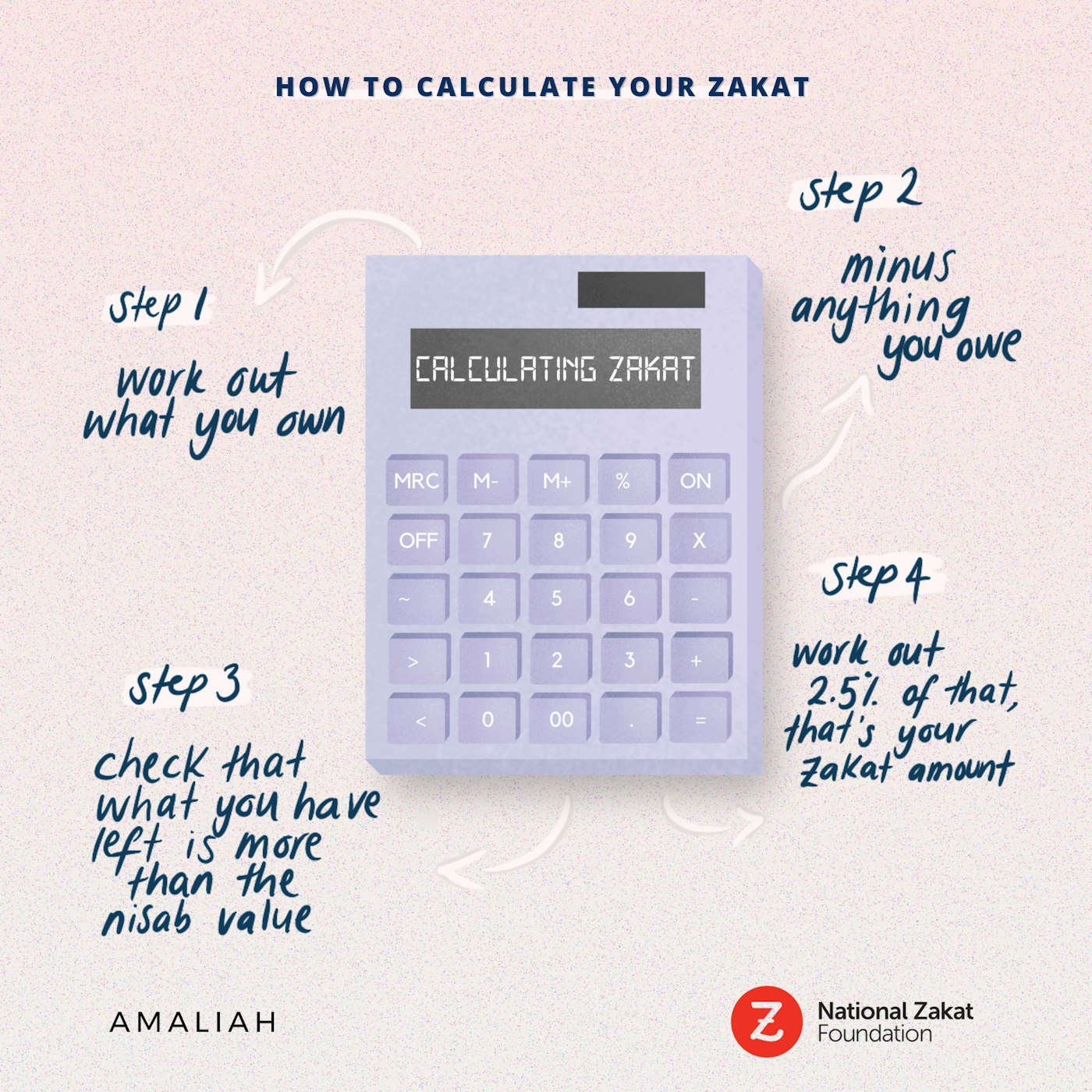

National Zakat Foundation also explains four basic steps to calculate your Zakat:

- Work out what you own, for example any cash or investments

- Work out what you owe, for example any debt. Don’t include things like future expenses and bills which are not yet due, for example, next month’s rent, and only include debts that are payable in the next 12 months, for example a student loan which is not owed until your studies are complete.

- Work out the difference between the two, and check that the balance is more than the Nisab value

- Work out 2.5% of that, and there you go, you’ve got your Zakat amount

Use the step-by-step calculator available on their website to further calculate the amount you owe.

Here’s an example of a Zakat calculation using the steps above:

Step 1: Working out what you own

- Let’s say you have £3000 in savings

- £1000 in your current account

- Some gold you wear worth £580

- Someone owes you £100

- You have an investment worth £2200 today. And you’ve recently come back from holiday and have about £40 in foreign currency that you haven’t spent.

- The total of what you own would be £6,920

Step 2: Work out what you owe

Let’s say you have a student loan debt of £50,000, and each month you pay back £50, you would only include how much you would pay over the next 12 months. That would come to a total of £600. This 12-month calculation also applies to mortgages – you don’t take the full amount into consideration, just those 12 months.

Step 3: Work out the difference between the two

Take away how much you owe from how much you own. In this case, that would be £6320.

Step 4: Check that the balance is more than the Nisab value

Currently on the National Zakat Foundation website, the Nisab rate for gold is £3915.85 and for silver, it is £330.31. If you choose to use the silver rate – which is more commonly used – your total of £6320 is more than the Nisab threshold which means you owe Zakat.

Step 5: Work out 2.5% of that

In this case, our Zakat amount is 2.5% of £6320, which is £132.25.

5. When do you need to pay Zakat?

Zakat is paid once a year. The Islamic calendar is based on the lunar year, which is around 354 days. Your Zakat is owed one lunar year from the date that your wealth first equals or exceeds the Nisab rate and it needs to be paid immediately on that date. The date will be used again in the following year as your “Zakat anniversary”.

For example, if you reached the Nisab rate on the 1st of Dhul Hijjah last year, then that same date is your “Zakat anniversary” this year. If your wealth does not equal the Nisab rate on your Zakat anniversary, you are not required to pay Zakat.

You don’t have to pay your Zakat in Ramadan but some people prefer to do that to get extra rewards of the blessed month.

See more: NZF – When to pay Zakat

It is recommended to pay the entire amount of Zakat at once, as soon as it is due and not to delay unnecessarily.

The Messenger of Allah ﷺ said, “Do not show lethargy or negligence in giving alms and charity till your last breath.” (Bukhari and Muslim)

However, we are permitted to divide the payments in instalments as long as it is in advance, and the balance is paid before the year is over. For further clarification, it is always best to consult your local imam.

See more: NZF – Paying your Zakat Monthly

6. Should a 5-year old pay Zakat?

If a 5-year-old child has inherited £3000, whether they pay Zakat on their money depends on your view of Zakat. There are two different views and both of them are correct.

The first is that zakat is payable on the wealth and so 2.5% should be paid regardless of whether the child has reached puberty or not.

The second is that zakat is payable by the individual. As this individual has not hit puberty, and therefore not considered an adult in Islam, they do not need to pay Zakat on it.

7. Who should you be giving your Zakat to?

Zakat can be described as a social welfare system unique to Islam that redistributes wealth to specific types of people or groups in need.

In the Qu’ran, Allah mentions eight categories of people who are eligible to receive Zakat:

“Indeed, Zakat expenditures are only for

[1] the poor and

[2] the needy, and

[3] to those who work on [administering] it, and

[4] for bringing hearts together, and

[5] to [free] those in bondage, and

[6] for those in debt, and

[7] for the cause of God, and

[8] for the stranded traveller.

[This is] an obligation from God. God is All-Knowing, All-Wise.” [Qur’an 9:60]

See more: NZF – How Zakat Works

8. Can you give Zakat to family members?

To summarise, yes, you can give Zakat to family members that are in one of the above categories of eligibility and those that you are not already obligated to provide for.

9. The different types of Zakat

Just as there are many types of charity, there are also different types of Zakat. It’s important to understand what these different forms are and their meaning, so that we can give intentionally and ensure that our money reaches those that need it most. There are two main types of Zakat:

- Zakat Al-Maal: is Zakat on wealth. This is where you pay 2.5% of your wealth if you’re above the Nisab threshold. It can be paid any time of the year, but most people leave it for the month of Ramadan as good deeds during this time result in a multiplication of rewards and blessings.

- Zakat Al-Fitr: This is given to the needy at the end of Ramadan but must be paid before the Eid prayer. Zakat Al-Fitr is compulsory on every Muslim who has enough to sustain themselves for one whole day and it is paid by the head of the household for each family member. The amount to be paid per person is typically the cost of a single meal. This can usually be paid to mosques or online.

10. What if you miss your Zakat?

The Qur’an describes Zakat as a way to attain Allah’s mercy.

We are all human and we all make mistakes. It’s possible to miscalculate the amount we owe for Zakat or to miss a payment altogether but it’s important to remember that Zakat is one of the key pillars of our faith, just like Salah and Fasting. In those instances where we miscalculate or miss our Zakat payments, the amount you owe should be calculated and paid immediately.

The National Zakat Foundation has a useful guide on what to do if you miss your Zakat payment and they also offer free one-to-one consultations with a Zakat expert if you need extra support with calculating your Zakat.

May Allah accept our fasting and our Zakat, and may our deeds be a shade for us on the Day of Judgement. Ameen

Read more:

*Every now and then we partner with companies to bring you sponsored content, this helps us keep going at Amaliah. We always strive to ensure we maintain the same editorial integrity that keeps you engaged in our non-sponsored content. We thank you for your support.

Amaliah Team

This article was written by a member of the Amaliah team or a collective team effort. You can follow us on @amaliah_tweets for the latest or head over to our Instagram @amaliah_com. If you're reading this and are thinking about contributing an article then send us an email with a brief or a full article to contribute@amaliah.com